Service for every investor

Why Individual investors choose us

Access pre-screened European startups and scale-ups with institutional-quality support.

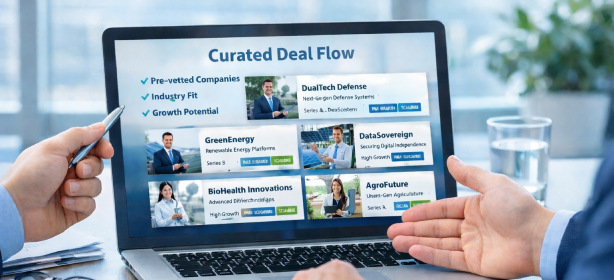

Curated opportunities

Pre-screened startups matching your investment criteria and portfolio strategy.

Early access

Be the first to review and engage with promising investment opportunities.

Due diligence support

Comprehensive analysis and sector expertise to inform investment decisions.

Networking events

Connect with fellow investors, corporates, and portfolio companies.

Why Institutional investors choose us

Tailored access to Europe's innovation ecosystem with institutional-grade deal flow.

Curated deal flow

Vetted European opportunities across strategic se ctors.

Co-investment network

Partner with other institutional investors on large-scale opportunities.

Strategic sector focus

Priority access to defense, energy, digital sovereignty, and biotech deals.

Market expertise

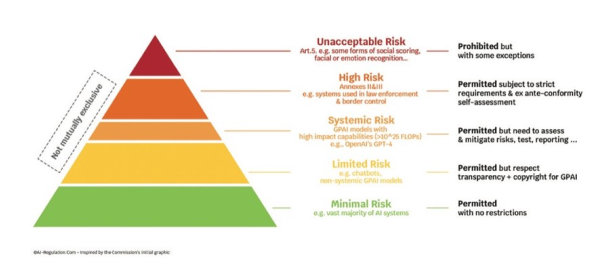

Deep insights into European regulatory landscape and market dynamics.

Why Investment Funds partner with us

Institutional-grade access to European innovation across all investment stages.

Deal sourcing

Curated European opportunities across all stages.

Co-investment

Partner with other funds for larger investment rounds.

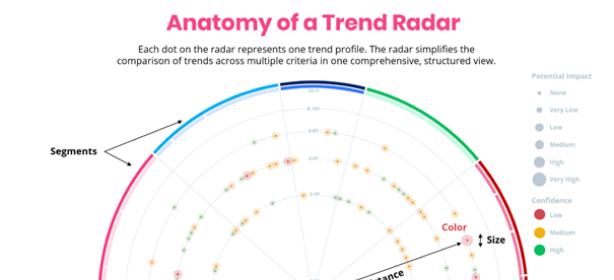

Market intelligence

Deep insights into European market trends and opportunities.

Portfolio support

Post-investment support and growth acceleration services.

Why Corporations partner with us

Access Europe's innovation ecosystem to drive transformation and strategic growth.

Innovation scouting

Discover breakthrough technologies and solutions for your industry.

Strategic partnerships

Form joint ventures and partnerships with European innovators.

CVC opportunities

Access curated investment opportunities through your CVC arm.

Market intelligence

Stay ahead of industry trends and emerging technologies.